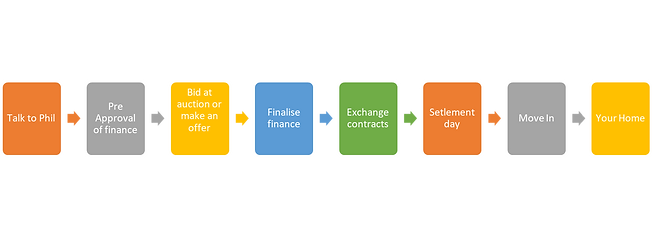

Road Map

Pre-approval support & advice

Using an online Fact Find system, you will tell us about your goals and financial position. This will save everything so you can view or update your profile at any time.

Don’t worry if you’re not ready to go right now - we understand it’s a long process and we’ll be there if you need us.

We’ll review your situation, talk through your options and if you’re ready to go - start to get things moving. If you have any questions don’t hesitate to ask. Speaking to someone who gets it can really make a difference.

Lodging your application

When you’re ready to proceed, the next step is to prepare and lodge your full application. Lenders need to see documents that provide proof for the information you’ve provided, so now is a good time to start gathering documents like:

• Identification (driver’s licence, birth certificate)

• Income (recent payslips, rental agreement)

• Assets (bank account statements, proof of ownership)

• Liabilities (credit card statement, loan statement)

Getting preliminary approval

This represents the initial thumbs up from your lender.

It gives you preliminary approval to borrow the funds you need based on the information you’ve supplied in your application.

The next step is usually to submit supporting documentation to validate everything. Once your application has been lodged we’ll keep you up to date with its progress and work with you to sort out all the paperwork required.

Getting final approval

This represents the final thumbs up from your lender.

Exciting times. Most of the hard work is over. Once this stage is complete your lender has committed to providing you with the money you need. Well done.

Once complete you’re basically good to go, and simply waiting for the purchase settlement date and release of funds.

Settlement / Receiving the money

Once this stage is complete you’re done. It means you have purchased the property or received all the funds from your lender and you now commence the process of paying back the loan.

You’ve got the money. It’s time to celebrate. Congratulations!

Protect and grow

This is the time to plan your next steps and protect you and your family in the future. We’ll stay in touch and help you get smarter with your money.

As with any financial scenario there are risks involved. This illustration provides an overview or summary only and it should not be considered a comprehensive analysis. You should before acting in reliance upon this illustration seek independent professional lending or taxation advice as appropriate specific to your objectives, financial circumstances or needs. Information included in the illustration has been sourced from third parties and has not been independently verified. Terms, conditions, fees and charges may apply. Normal lending criteria apply. Rates subject to change. Approved applicants only.